The rise and fall of Alex’s cleaning empire

I read a story in the news this week about a small business owner (Alex) who had lost his entire business – as well as his house, his car, his fishing gear – everything.

The businessman concerned was a 29 year old who owned a cleaning company. You have to admire someone who, at that age, has built a company from the ground up and ended up with eight significant cleaning contracts to large organisations.

The only problem was that they were all with the same organisation. Alex had cleaning contracts with eight separate McDonalds locations.

Five years to build, 12 hours to disappear

One day, he received an email from McDonalds informing him that all contracts were to be terminated. Immediately. Well, it was about 12 hours’ notice, but that counts as immediately to me.

McDonalds wished to “ … thank him for your commitment and service to McDonalds over the past few years”, but I’m sure that those kind wishes didn’t make Alex feel much better at the time.

Alex bravely started legal proceedings, believing that he had a 24 month contract with the company. That didn’t last long – McDonalds hired a global law firm, and Alex had, well, not much. He quickly ran out of money and his five-year-old company went into liquidation.

The liquidators of Alex’s company may decide to continue the legal case against McDonalds. However, the legal niceties of this case are not our concern here. This story is a rolled-gold, case-study example of how a small business owner can be plunged from apparent success to bankruptcy in a microsecond when a large customer changes its mind. For the record, Alex had been performing some cleaning and maintenance work for McDonalds when he was asked to expand his services. Clearly his client was happy with his work, because he quickly acquired the aforementioned eight contracts.

The liquidators of Alex’s company may decide to continue the legal case against McDonalds. However, the legal niceties of this case are not our concern here. This story is a rolled-gold, case-study example of how a small business owner can be plunged from apparent success to bankruptcy in a microsecond when a large customer changes its mind. For the record, Alex had been performing some cleaning and maintenance work for McDonalds when he was asked to expand his services. Clearly his client was happy with his work, because he quickly acquired the aforementioned eight contracts.

The mistake that Alex had made was building his business around just one large customer. I know that every small business has to start with just one large buyer (just as we did back in 1997), but staying with just that one client is fraught with danger – as Alex found out.

There are far too many Alex stories

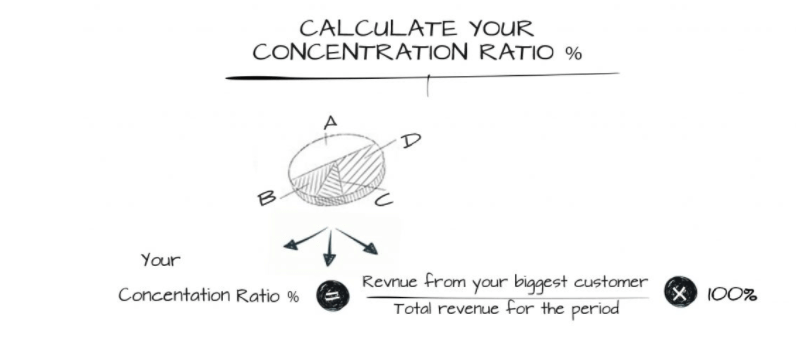

The tale of Alex is, unfortunately, all too common. This enterprising young businessman had allowed his Customer Concentration Ratio to remain at 100%. Your Customer Concentration Ratio measures how dependant you are on your biggest customers.

What’s the correct Customer Concentration Ratio?

What’s the correct Customer Concentration Ratio?

This is one of those “How long is a piece of string?” questions. There’s no “correct” answer. I do know though, that unless there are extremely unusual circumstances, 100% is not the right answer.

The correct number for you will vary with the stage of your business (startup vs mature), what industry you are in, the size of your business, and several other variables. However, if your number is above 20%, it’s probably worth your while taking time to assess your risk.

As do most small business owners, you may very well have your family assets encumbered through your business. (Most banks will only make Small Business loans with hard assets as collateral. For most, that means the family home). Having a high Customer Concentration Ratio is putting all those assets on the line.

As do most small business owners, you may very well have your family assets encumbered through your business. (Most banks will only make Small Business loans with hard assets as collateral. For most, that means the family home). Having a high Customer Concentration Ratio is putting all those assets on the line.

Don’t be Alex.